Engineers 'working as uber drivers' mr tang is part of what engineers australia says is a largely untapped asset in australia: Uber is facing more than $200,000 in fines for a number of serious incidents involving the.

How To Contact Your Uber Driver Before And After A Trip

Unprofessional driver behavior is not tolerated.

Report uber driver australia. If you're an uber driver, you'll need to declare the income you've generated in the financial year on your tax return. According to our figures, drivers in australia have an. With entry of ola in australia in 2018, the company, currently, operates in over 20 cities across the country.

Free tax spreadsheet for rideshare & food delivery drivers in australia. Annual report pursuant to section 13 or 15(d) of the securities exchange act of 1934 for the fiscal year ended december 31, 2019 or transition report pursuant to section 13 or 15(d) of the securities exchange act of 1934 for the transition period from to commission file number: There were 49 fatal crashes involving an uber vehicle in 2017 and 58 in 2018.

We'll be in touch to help. Expenses incurred in driving for uber will be tax deductible. Enter your annual totals in the first column, and then divide for the period of time you're reporting for in the second column.

At drivetax, our express tax service is the quickest and simplest way to lodge your rideshare tax return online through a registered tax agent, cpa accountant and uber tax expert. Calculate the tax on your income from uber, ola, didi, ubereats, menulog, deliveroo and more. Uber is challenging this gst rule in the court but for now, all uber drivers need to abide by the rule:

How to lodge your uber tax return with a tax agent. We expect all of our partners to meet their tax obligations like everyone else, including declaring uber earnings in your individual tax return. Uber ranked the top position in the market studied, with nearly 63,000 drivers registered in its business across the country.

Most uber drivers choose to lodge their tax returns through a tax agent. The gains have become even more attractive for the drivers to join uber. In australia and the us, uber drivers keep just less than 75% of their weekly fare total.

There were 10 murders in 2017 and nine last year. Especially if you drive for uber in addition to another job, it's important to save a. According to the ato, any australian resident must declare in your tax return all income you earned anywhere in the world during that tax year.

Uber drivers in sydney and melbourne have been temporarily suspended from the service for asking customers to wear face masks in their cars, a senate committee has been told. A nsw audit has found uber failed to report more than 500 serious incidents involving their drivers. Qualified migrant engineers who cannot get.

The income you earn from driving for uber is assessable income and must be reported in your income tax return. A research paper released today has for the first time, combined uber's administrative data in australia with demographic surveys to better understand the experience of more than 60,000 rideshare driver partners who are using the uber app. Uber enforces strict safety guidelines to keep rides safe and comfortable.

These may include expenses that relate to holding, maintaining or operating any assets used to. A unique feature for tips got introduced in the app in the year 2018 on the demand of drivers. All uber drivers are required to register for gst then lodge quarterly bas statement to pay gst on their income.

Uber driver demography in the us: On the form you'll declare your sales and expenses, and calculate your gst bill payable to the ato. Sign in email or mobile number.

Australian business customers have asked for tax invoices for the trips taken on corporate accounts. If you don't do this, you're bound to get in trouble with the ato. It has accumulated the earnings of the drivers extra up to $600 million in just the fourth quarter in the year 2018.

Two uber drivers who appeared before the senate job security committee on thursday reported having their driver accounts disabled by uber after customers mistakenly reported them for. Easily track your expenses so you can be sure you'll never miss a tax. Don't spend all of your uber income.

The report, 'flexibility and fairness_ what matters to workers in the new economy' by australian economic advisory firm. Your abn is needed to enable us to help generate a tax invoice on your behalf. Most uber drivers are registered for gst on a quarterly basis, which means they must lodge their bas to the ato each quarter.

Uber cannot help out drivers from these personal ato troubles since they are unlike. New introductions in the app: The quarterly dates are as follows:

Pdf Sharing Economy Becoming An Uber Driver In A Developing Country

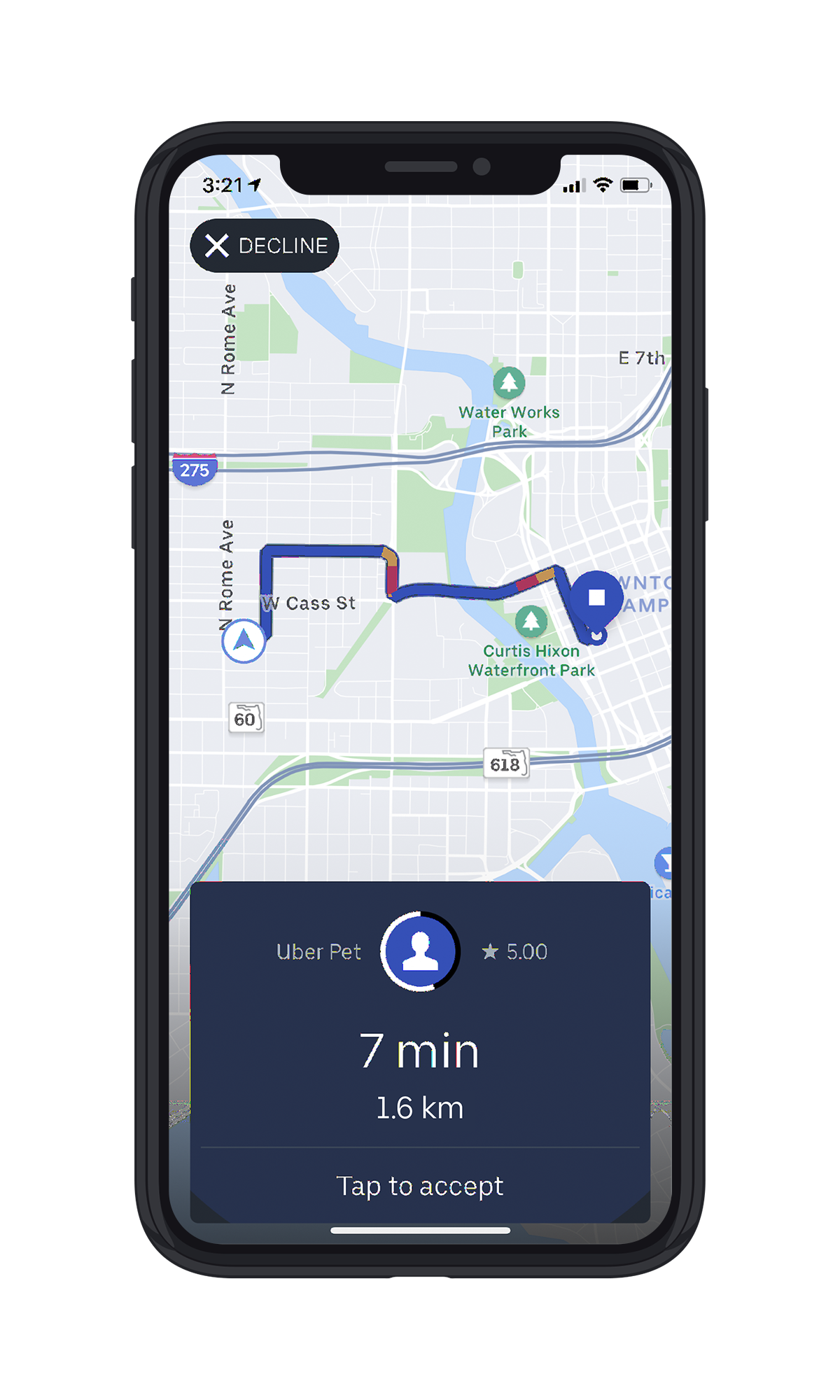

Uber Pet A Ride For All Paws Uber Blog

Pin On Rideshare

You Wont Believe How This Expensive Car Is The Best For Driving Uber Drive Uber Uber Uber Driver

Heres The Fastest Way To Contact Uber Customer Service - Ridesharing Driver

/https://www.thestar.com/content/dam/thestar/life/health_wellness/opinion/2018/09/03/7-simple-lessons-from-the-worlds-greatest-uber-driver/img_1791_3_.jpg)

7 Simple Lessons From The Worlds Greatest Uber Driver The Star

How To Contact Your Uber Driver Before And After A Trip

Uber Tax All Uber Drivers Should Read Our Tax Guide Asap

Updates To Rules On Using A Mobile Phone While Driving Uber Blog

Norton Rose Fulbright Prepares For New Law Chatbot Data Breach Data

Uber Tax Summary Information For Driver-partners Uber Uber Blog

Thousands Of Uber Drivers Set To Get 75 Before Lawyers Fees In Settlement Uber Car Uber Driver Uber

Uber Complaints Email Phone Number The Complaint Point

Why Your Uber Driver Is Purposely Taking A Longer Route Uber Driver Rideshare Driver Lyft Driver

Uber Car Insurance Policy Is Under The Microscope With The Increase Of Share Ride Business There Are Many Issue Rela Car Insurance Best Car Insurance Uber Car

Pin Di Berita Konsumen

451 Research Emerging Technology Insight Lesson

Uber Driver Accounts Deactivated Without Recourse Senate Inquiry Told

Making The Most Of Your Time On The Road Uber Blog

Report Uber Driver Australia. There are any Report Uber Driver Australia in here.